BLOG

What is the difference between CA Diploma and ACCA Certificate?

Writer: admin Time:2025-04-12 10:08 Browse:℃

Which website can buy fake CA diploma certificates, order CA diploma certificates online.

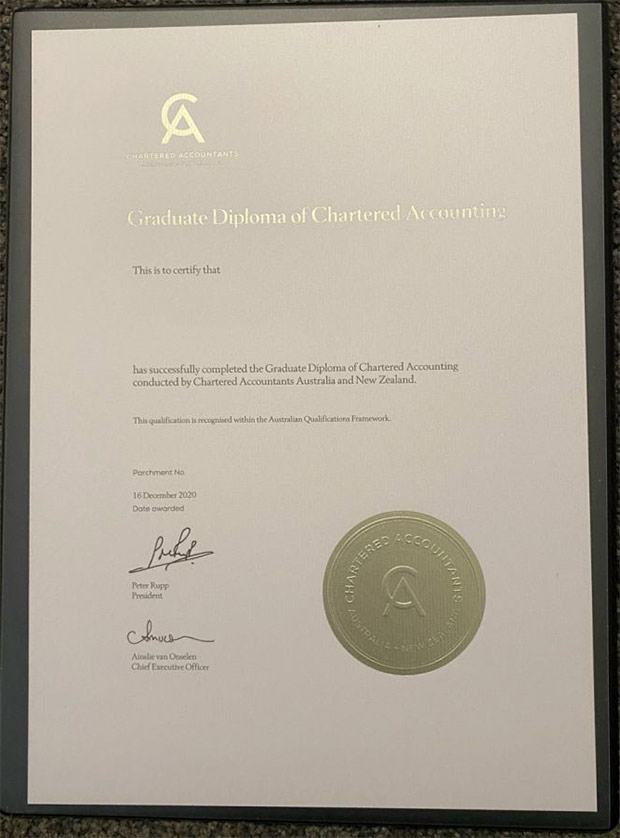

(2020 CA diploma certificate)

What is the difference between CA Diploma and ACCA?

The CA Diploma (Chartered Accountant Diploma) and ACCA (Association of Chartered Certified Accountants) are both prestigious qualifications in the field of accounting, but they differ in several key aspects such as their structure, recognition, and global reach.

1. Qualification Structure

-

CA Diploma: This is typically a qualification offered by a national or regional accounting body, such as the Institute of Chartered Accountants of India (ICAI), Institute of Chartered Accountants of England and Wales (ICAEW), or similar bodies in other countries. It involves rigorous exams and practical experience requirements. The path to becoming a Chartered Accountant (CA) generally involves:

-

Completing foundational exams (often covering accounting, taxation, auditing, etc.)

-

Gaining practical experience (usually 3-5 years of training under a licensed CA)

-

Completing a professional exam at the end of the training period.

-

-

ACCA: The ACCA qualification is offered by the Association of Chartered Certified Accountants, which is a global body. It has a more flexible structure, offering:

-

A series of exams (14 in total, but you may be exempt from some based on prior qualifications).

-

A requirement for three years of practical experience.

-

Focuses on a broad international curriculum, covering areas such as financial management, management accounting, taxation, and auditing.

-

2. Global Recognition

-

CA Diploma: The recognition of a CA qualification is typically more region-specific. For example, a CA qualification from India or South Africa is highly respected in those countries and in some Commonwealth countries, but it may not be as universally recognized as the ACCA qualification.

-

ACCA: The ACCA qualification is globally recognized and respected in over 180 countries. It’s particularly popular in the UK, Europe, Africa, Asia, and many other regions. This makes ACCA an attractive choice for individuals aiming to work internationally.

3. Entry Requirements

-

CA Diploma: Entry requirements can vary depending on the country, but generally, you may need a background in accounting, commerce, or a related field. Some countries may require university-level education before entering the CA program, while others may allow students to enter directly after high school or after completing an undergraduate program.

-

ACCA: ACCA also has flexible entry requirements. You can start after completing high school or after gaining a degree in a related field. It has an open entry policy (with some exceptions), and it provides multiple entry points depending on your prior qualifications. If you already have a relevant degree, you can be exempt from some exams.

4. Curriculum Focus

-

CA Diploma: The CA qualification focuses deeply on technical accounting, taxation, auditing, and legal aspects of business in the specific jurisdiction of the CA body. For example, a CA from India will have a strong focus on Indian taxation, laws, and accounting standards (Indian GAAP), which might differ from international standards.

-

ACCA: The ACCA qualification has an international curriculum with a focus on global accounting practices, IFRS (International Financial Reporting Standards), taxation, and financial management. It’s designed to be versatile, providing a broad understanding of accounting principles that can be applied worldwide.

5. Exemptions and Flexibility

-

CA Diploma: CA programs generally do not offer the same level of flexibility in terms of exemptions as ACCA. Once you’re enrolled in a CA program, you typically follow a fixed path.

-

ACCA: ACCA offers exemptions based on prior academic qualifications. For instance, if you have a degree in accounting or a related subject, you can be exempted from some of the foundational exams, which can reduce the time and effort required to complete the qualification.

6. Duration and Completion Time

-

CA Diploma: The time it takes to complete a CA diploma depends on the country and your progress through the required exams and practical experience. Typically, it can take around 3-5 years.

-

ACCA: The duration of completing the ACCA qualification can vary significantly. If you pass all exams without exemptions, it can take around 3-4 years. However, it could be shorter if you receive exemptions or are able to study full-time.

7. Professional Development and Opportunities

-

CA Diploma: Being a Chartered Accountant opens the door to high-level positions in accounting, auditing, taxation, and finance. It’s highly regarded in fields like public accounting, auditing firms, and finance departments of large companies. CA holders often progress into senior finance roles, including CFOs.

-

ACCA: ACCA members also enjoy opportunities in audit, financial management, taxation, and consulting. The global nature of ACCA means that members have the opportunity to work in a wide variety of countries and sectors, from multinational corporations to non-profits. It is often seen as a stepping stone for individuals pursuing international careers in finance.

8. Cost and Maintenance

-

CA Diploma: The cost of the CA qualification can vary widely depending on the country, but it can be more expensive because of the fees for exams, training, and membership in professional bodies. In addition, maintaining the CA status often requires continuing professional development (CPD).

-

ACCA: The ACCA qualification involves exam fees, registration fees, and annual membership fees. The cost may be considered lower compared to CA programs in some countries, especially since ACCA offers various study options, including self-study and online programs. Like CA, ACCA also requires ongoing CPD to maintain membership.

9. Local vs International Focus

-

CA Diploma: CA is more focused on local regulations and tax laws of a particular country. It’s tailored for professionals who intend to practice within the legal and regulatory environment of their specific country.

-

ACCA: ACCA has an international outlook, offering a global perspective on accounting, which makes it suitable for professionals planning to work in multinational organizations or countries outside their home region.

-

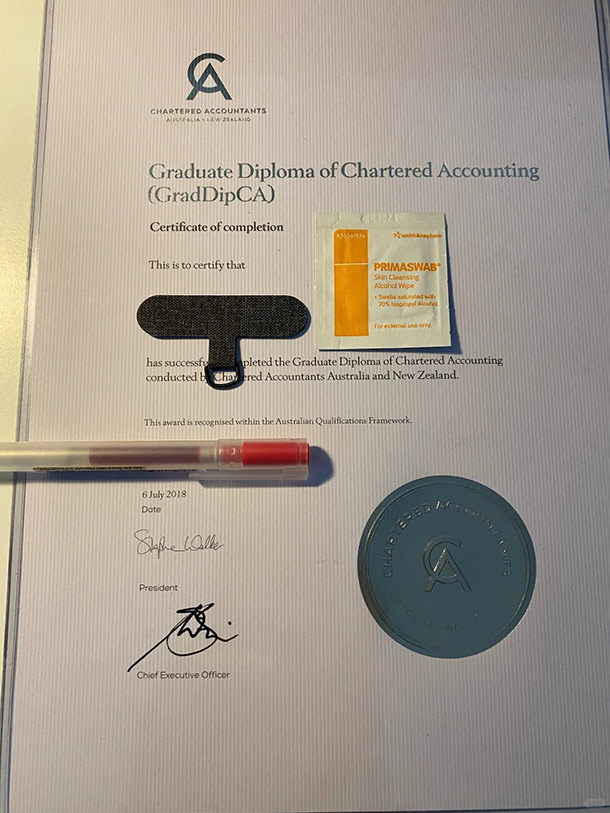

- (2018 CA diploma certificate)

Duties and Responsibilities of Chartered Accountants (CAs)

Chartered accountants (CAs) earn their designation based on the rules and regulations of the country in which they work. CAs work for organizations, businesses, governments, and individuals in both the private and public sectors. They generally focus on one of four areas:

- Applied finance

- Financial accounting and reporting

- Management accounting

- Taxation

(2022 CA diploma certificate)

(2022 CA diploma certificates)

(2022 Fake CA diploma certificate)

How can I get a CA Diploma Certificate?

To complete the GradDipCA, you must successfully complete nine subjects (seven core and two electives), totalling 120 credit points. For important information on credit points, refer to the GradDipCA Course Information below.GradDipCA duration: Typically, one year full-time, or two or more years part-time, depending on when commenced.

CATEGORIES

LATEST NEWS

CONTACT US

Wechat: 236461877

WhatsApp: +86 13690285467

Email: diplomacenter@qq.com