BLOG

How do I get a CFA certificate and how much does it cost to buy one?

Writer: admin Time:2025-03-31 17:04 Browse:℃

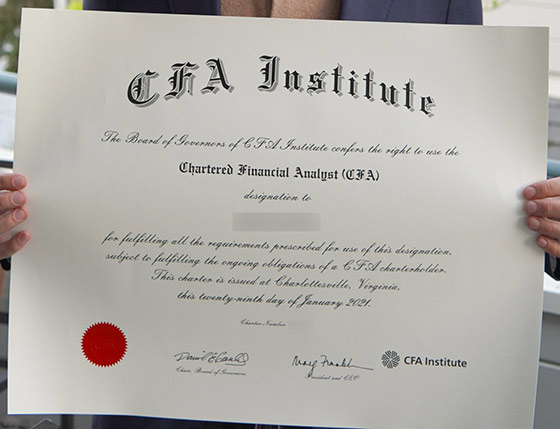

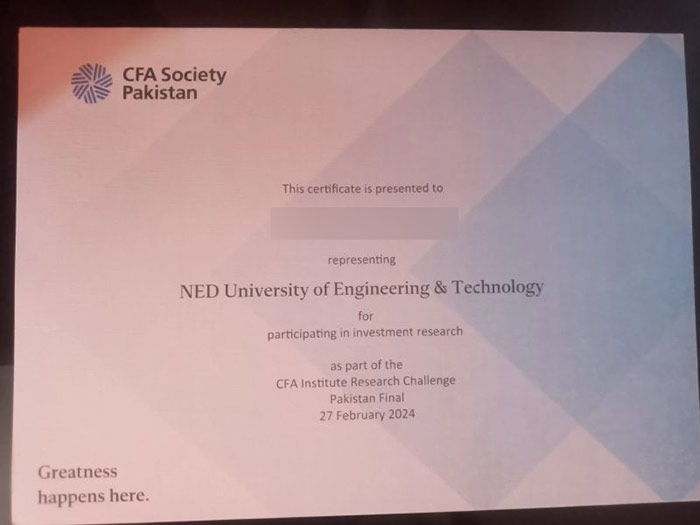

(Sample of 2021 CFA certificate)

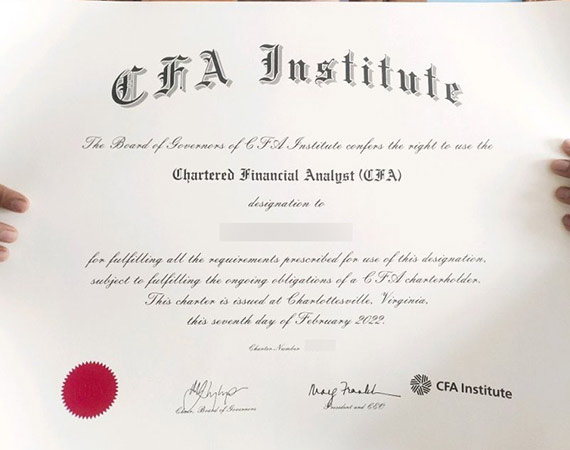

(Sample of 2022 CFA certificate)

What does the CFA Certificate do?

The CFA (Chartered Financial Analyst) Certificate is a prestigious designation awarded by the CFA Institute to professionals in the field of finance, particularly those involved in investment management, financial analysis, and portfolio management. The CFA program is recognized worldwide for its rigorous curriculum and emphasis on ethics, financial analysis, and professional excellence.

Here’s what the CFA Certificate specifically represents:

-

Expertise in Financial Analysis and Investment Management: Earning the CFA designation demonstrates a high level of expertise in areas like financial modeling, valuation, economics, corporate finance, equity analysis, and fixed-income investments.

-

Global Recognition: The CFA is widely respected in the finance and investment industry. It’s particularly valuable for individuals who want to work in investment management, portfolio management, equity research, risk management, or corporate finance roles.

-

Ethical Standards: The CFA program places a strong emphasis on ethics and professional conduct. Candidates must adhere to a code of ethics and standards of professional conduct, which is a key part of the designation.

-

Career Advancement: Having the CFA credential can significantly improve career prospects, providing professionals with more job opportunities, higher salaries, and a greater likelihood of landing senior positions in finance.

-

Structured Learning Path: The CFA program consists of three levels (Level I, II, and III), each focusing on different aspects of financial analysis and investment management. Passing all three levels and fulfilling relevant work experience requirements earns you the CFA charter.

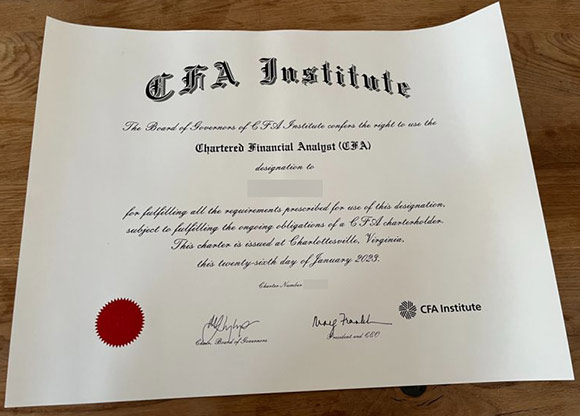

(Sample of 2023 CFA certificate)

What is the CFA certificate?

(Sample of 2023 CFA certificates)

Enrollment criteria and requirements

Bachelor's Degree

Complete a bachelor’s program or equivalent program and received a university/college degree. If you’re not sure if your program is comparable, ask your college or university.

Junior or Senior University Student

Professional Work Experience

Have a combination of 4,000 hours of work experience and/or higher education that was acquired over a minimum of three sequential years and achieved by the date of registering for the Level I exam. The dates of education and professional work experience cannot be overlapping. If you have a combination of work experience and higher education to achieve the minimum hours and years, assume that higher education takes 1,000 hours per year.

Professional work experience does not need to be investment related. Internships/articleships are accepted if they are paid. Work experience with your own business or your family business will qualify only if it is professional experience for which you are paid.

What does professional work experience mean? Professional work experience requires specialized knowledge, education, or advanced skills. Professional work experience requires the application of higher-level judgement and business skills, including:

- Leadership and teamwork

- Business communications

- Critical thinking and problem solving

- Time management

- Professional judgement

- Analytical skills

- Adaptability

Candidates applying to register for CFA Program without completing a bachelor’s degree must honestly evaluate whether their professional work experience has equipped them for the significant volume and depth of study demanded by CFA Program.

Please note that CFA Institute may request proof of education (copy of diploma, marksheet, any other relevant documents) and/or work experience (letter of employment, salary slips, any other relevant documents) to be submitted at any stage of your journey as a candidate or even after becoming a member in order to demonstrate entrance requirements were met. Failure to provide requested documentation relevant to entrance requirements may result in cancellation of a current exam registration, withholding of exam results, voiding of past exam results, and may lead to investigation and disciplinary action by the CFA Institute Professional Conduct Program.

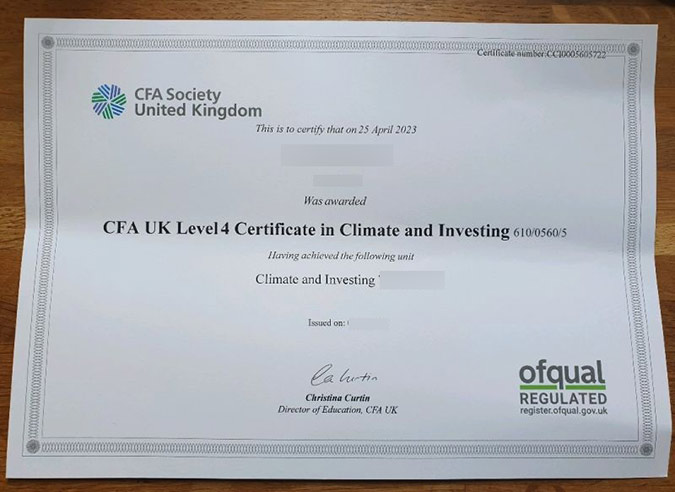

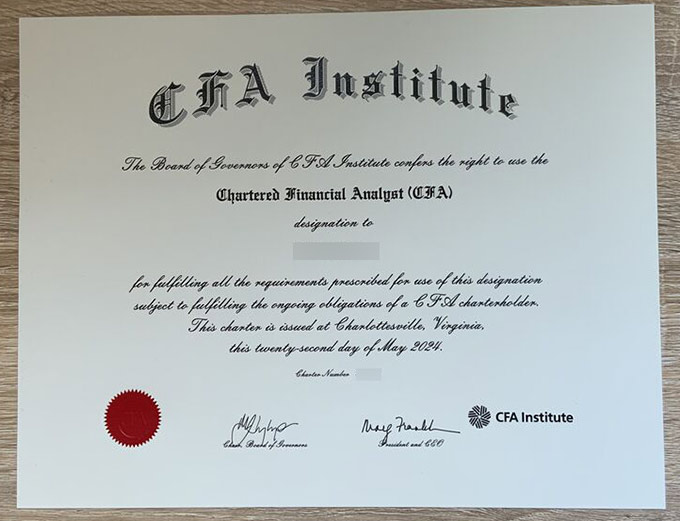

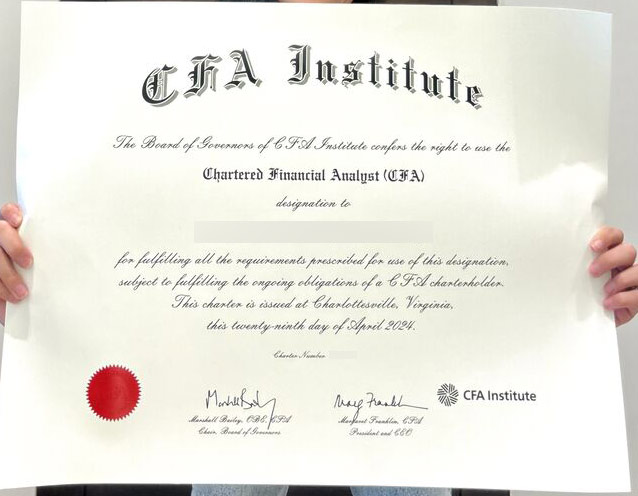

(Sample of 2024 CFA certificate)

(Sample of 2024 CFA certificates)

To earn the CFA (Chartered Financial Analyst) certificate, you need to follow a series of steps that involve meeting educational requirements, passing exams, gaining relevant work experience, and adhering to ethical standards. Here’s a breakdown of the process:

1. Meet the Eligibility Requirements

-

Educational Requirements: You must have a bachelor’s degree (or be in your final year of university) or have at least four years of professional work experience. The work experience can be in areas such as financial analysis, investment banking, or portfolio management.

-

Professional Experience: Alternatively, you can have 4,000 hours of work experience (over a minimum of 36 months) in investment-related roles.

-

Language Requirements: The CFA exams are conducted in English, so you must be proficient in English.

2. Register for the CFA Program

-

Create an Account: Start by creating an account on the CFA Institute website.

-

Choose Your Level: There are three levels of exams (Level I, Level II, and Level III), and you need to take them sequentially. You can register for Level I after meeting the eligibility criteria.

-

Registration Fee: There’s a registration fee for each exam level. Early registration will cost less than late registration.

3. Prepare for the CFA Exams

-

Study Materials: The CFA Institute provides study materials, including the CFA curriculum for each level. Many candidates also choose additional third-party study guides, courses, or online programs to help with preparation.

-

Exam Content: Each level of the CFA exam covers different topics:

-

Level I focuses on basic financial analysis, ethics, and quantitative methods.

-

Level II dives deeper into asset valuation and financial reporting.

-

Level III focuses on portfolio management and applying the knowledge gained from Levels I and II.

-

-

Time Commitment: On average, candidates spend 300+ hours preparing for each exam level.

4. Pass the CFA Exams

-

Level I Exam: This is typically a computer-based exam with multiple-choice questions. It tests knowledge of basic concepts, financial instruments, and ethics.

-

Level II Exam: This is also a computer-based exam but includes more complex questions focused on valuation, financial analysis, and application of tools in real-world scenarios.

-

Level III Exam: This exam includes both multiple-choice questions and constructed-response (essay) questions, focusing on portfolio management, client relations, and applying knowledge across different investment strategies.

Exam Timeline:

-

Level I: Offered in February, May, August, and November.

-

Level II: Offered in May and August.

-

Level III: Offered in May and November.

5. Gain Relevant Work Experience

-

You need at least four years of professional work experience in investment decision-making or other related fields, which can be gained before, during, or after taking the exams.

-

The experience should involve responsibilities like investment analysis, portfolio management, or financial consulting, and must be approved by the CFA Institute.

6. Submit the CFA Institute Membership Application

-

After passing all three levels of the exam, you need to become a CFA Institute member. This involves submitting your work experience for approval, agreeing to adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct, and paying the annual membership fee.

-

Membership grants you access to resources and networks, and it's a necessary step to officially earn the CFA charter.

7. Receive the CFA Charter

-

Once you pass the exams, fulfill the work experience requirement, and gain CFA Institute membership, you will be awarded the CFA charter.

Summary of Steps:

-

Ensure Eligibility (Bachelor’s degree or work experience).

-

Register and Pay for the CFA Program.

-

Prepare for the Exams (300+ hours per level).

-

Pass the Exams (Levels I, II, III).

-

Gain Relevant Work Experience (4,000 hours in a related field).

-

Submit Membership Application and Adhere to Ethical Standards.

-

Receive the CFA Charter.

(Samples of 2024 CFA certificate)

CATEGORIES

LATEST NEWS

CONTACT US

Wechat: 236461877

WhatsApp: +86 13690285467

Email: diplomacenter@qq.com