BLOG

Which website can purchase Texas CPA certificate

Writer: admin Time:2024-09-13 17:16 Browse:℃

-

Career Opportunities: Many accounting and finance positions require or prefer candidates with a CPA certification. It opens doors to roles such as auditor, tax advisor, financial analyst, and CFO.

-

Credibility and Trust: The CPA designation is widely recognized and respected. It signals to employers, clients, and the public that you have met rigorous education and experience requirements and have passed a comprehensive exam.

-

Professional Development: The process of becoming a CPA involves extensive study and ongoing professional education, which helps in staying current with industry standards and practices.

-

Regulatory and Compliance Roles: CPAs are often involved in regulatory compliance and auditing roles, which are critical for businesses to meet legal and financial reporting standards.

-

Increased Earning Potential: CPAs generally command higher salaries compared to non-CPA counterparts due to their specialized knowledge and the additional responsibilities they can handle.

-

Consulting and Advisory Services: With a CPA, you can offer specialized services such as financial planning, business consulting, and strategic advice, adding value to your clients or employer.

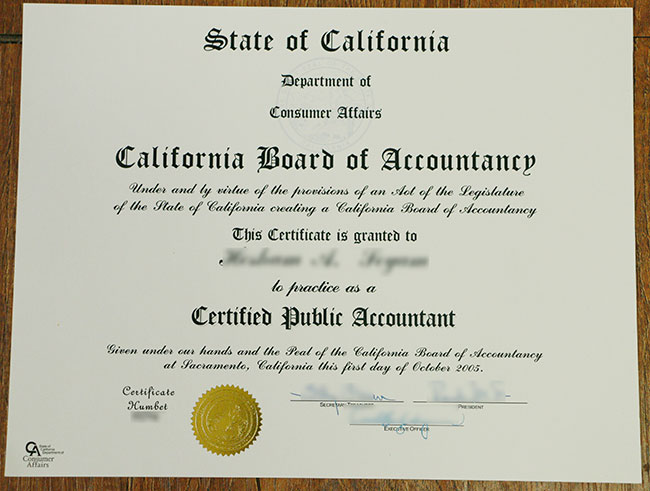

(2005 CPA Certificate)

(Chartered Professional Accountant Certificate)

To obtain a CPA (Certified Public Accountant) certificate, candidates typically need to pass the CPA Exam, which is administered by the American Institute of Certified Public Accountants (AICPA). The CPA Exam consists of four sections:

-

Auditing and Attestation (AUD): This section covers knowledge of auditing processes, standards, and ethics. It includes topics like the audit process, internal controls, and the auditor's responsibilities.

-

Business Environment and Concepts (BEC): This section focuses on general business concepts and the economic environment. It includes topics such as corporate governance, economic concepts, financial management, and information technology.

-

Financial Accounting and Reporting (FAR): This section tests knowledge of financial accounting and reporting frameworks. It includes topics such as financial statements, transactions, and reporting for various entities like businesses and governments.

-

Regulation (REG): This section covers regulatory aspects, including ethics, professional responsibility, and taxation. It encompasses topics like tax regulations, business law, and accounting for income taxes.

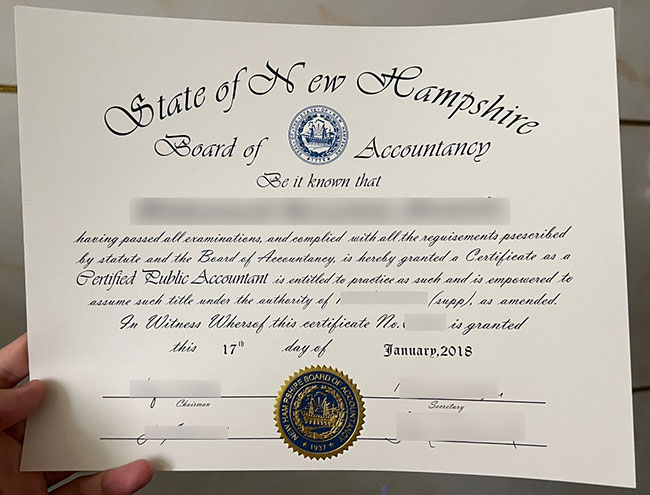

(2018 CPA Certificate)

CATEGORIES

LATEST NEWS

CONTACT US

Wechat: 236461877

WhatsApp: +86 13690285467

Email: diplomacenter@qq.com